From daily round business to long term value creation

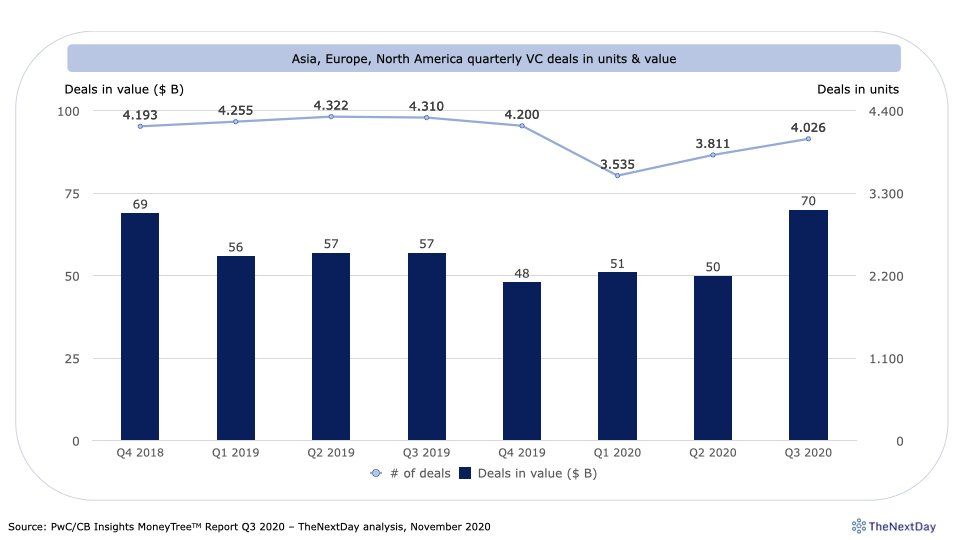

- a total global funding reaching $70 B (highest level since Q4 2018),

- an average deal size of $17 M (+33% vs Q2 2020),

- the Unicorns club surpassing 500 companies.

- new entrants,

- new products or services,

- new user experiences,

- new usages,

- new problem-solution fit,

- new industry boundaries,

- new business models, …

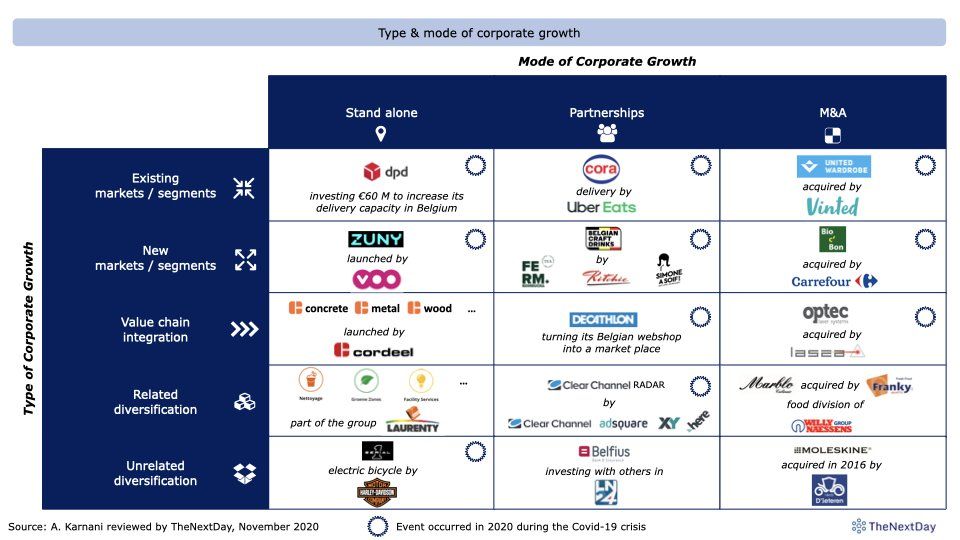

- market penetration or globalization,

- (un-)related diversification,

- vertical integration, …

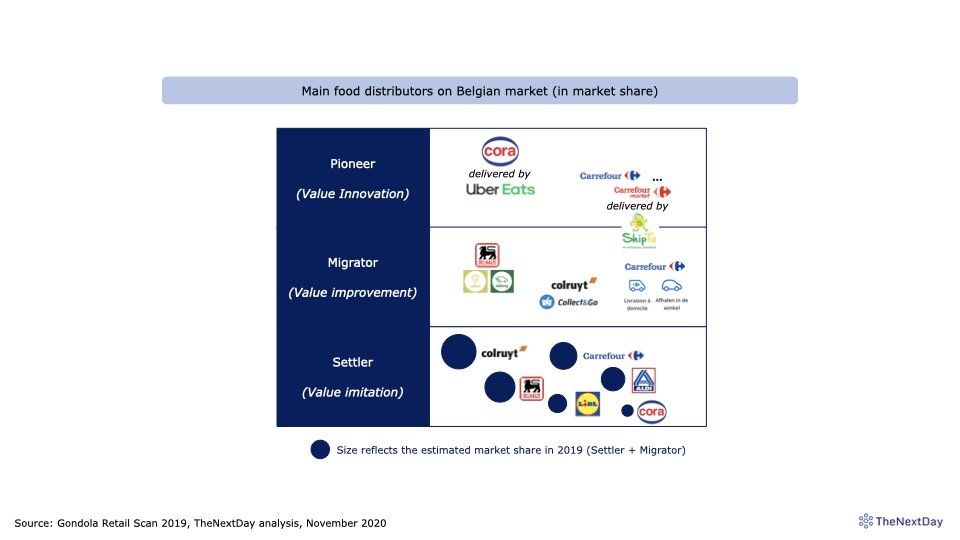

Cora delivery by Uber Eats

In October 2020, Cora signed a partnership with Uber Eats allowing Cora’s customers to order via the Uber Eats App prepared dishes but also fresh products, groceries, everyday essentials,… delivered by Uber Eats. The delivery should occur in 30 minutes within a radius of 3 kilometers.

With this partnership Cora has the ambition to answer new consumption habits of a younger audience.

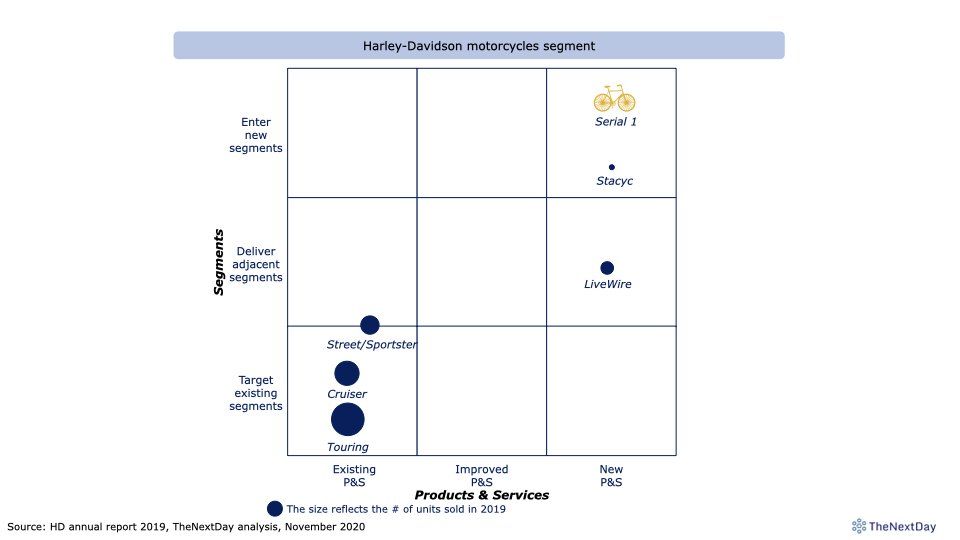

Serial 1 electric bicycle by Harley-Davidson

In November 2020, Harley-Davidson decided to enter the electric bicycle market, a new growing market for them, with a worldwide value of $15 B. The H-D strategic move is sustained by the launch of a new company, a new stand-alone brand “Serial 1”.

The main reasons of this market move were i) the Millennial & Gen Z seem less attracted by the current H-D portfolio, ii) this last does not answer current mobility concerns.

The new normal accentuates the digitalization needs, the environmental issues, the mobility concerns, the new organization of work,… This unique socioeconomic environment brought new problems, new needs, new usages, new ways of interacting, new users experiences, new business models, new solutions,…

The new normal abounds of business growth opportunities. Furthermore, a single cost reduction strategy i) has only a time, ii) is not inspiring for employees and customers, iii) does not create long term value.

So, whatever your sector, at one time or another your business growth will be linked to one of the types & mode of Corporate growth in order to capture new demand and not to fight only for existing customers.

It will create long term value for your company and shareholders.